If you want to do IT work for government agencies or the military, you may have wondered, “Will bad credit affect security clearance?” particularly if you think there may be a mismatch between the standards for security clearance and credit score on your application. When you apply for security clearance, your financial history and current standing are extensively reviewed, along with many other aspects of your life and personal history. You may be concerned that you just don’t have the credit score for security clearance. Imperfect financial circumstances, such as bad credit scores, can have a negative influence on your application and potentially cause your security clearance to be denied. In fact, financial issues comprise a large percentage of security clearance denials. However, the dollar amount associated with your financial troubles is usually less important than the reasons behind your financial situation, and steps you have taken to improve it.

Before you start to consider your credit score an absolute bar to obtaining security clearance, you need to learn more about how bad credit fits into the bigger picture of the application process. Let’s take a closer look at the many factors that can affect your security clearance application, including the influence of bad credit and other financial issues. We’ll also offer our best advice for obtaining security clearance—even if your financial circumstances are not ideal—and advancing your IT career.

WHAT FACTORS AFFECT SECURITY CLEARANCE?

Yes, your financial situation does matter in the security clearance application review process. In addition to finances, a lot of different aspects of your life will be reviewed if you apply for a security clearance. It’s important to accept that and keep your motivation in mind as you go through this process. When searching for a job in the IT industry, you have probably noticed that deciding to get a federal security clearance can benefit your career. However, if you decide to apply for security clearance, you should be prepared for a rigorous review of your application. The security clearance process takes into account not only your finances, but also many other aspects of your background, character, and current civilian conduct.

For context, as of 2017, the National Security Adjudicative Guidelines laid out a total of 13 criteria that an individual must meet in order to receive security clearance. These guidelines include evaluating your allegiance to the U.S., past criminal acts and indicators of future criminal conduct, and susceptibility to untoward foreign influence.

Ultimately, the Diplomatic Security Service (DSS) wants to ensure that individuals with security clearance privileges are highly trustworthy. Deciding who receives access to matters of national security is, understandably, not a decision the DSS takes lightly, and financial status makes up a portion of the broad overall picture of one’s suitability for a security clearance.

HOW MUCH DO FINANCES AFFECT SECURITY CLEARANCE? Is there a particular credit score for security clearance?

While you might be looking for a simple answer about finances specifically, such as a minimum credit score, the answer is more complicated than that. Your finances are one of the 13 factors considered by the Diplomatic Security Service when reviewing your security clearance application. But just how much weight are your finances given when deciding whether or not you should be granted security clearance?

With so many factors in play, it is difficult to quantify exactly how much your finances affect your eligibility for security clearance. However, it is evident that security clearance guidelines have toughened greatly in the last several years, attributed in part to individuals with security clearance who proved untrustworthy of national security. In light of this, certain potentially suspicious activities on your record, such as financial blemishes, may carry more weight than they once did.

WHAT FINANCIAL SITUATIONS AFFECT SECURITY CLEARANCE?

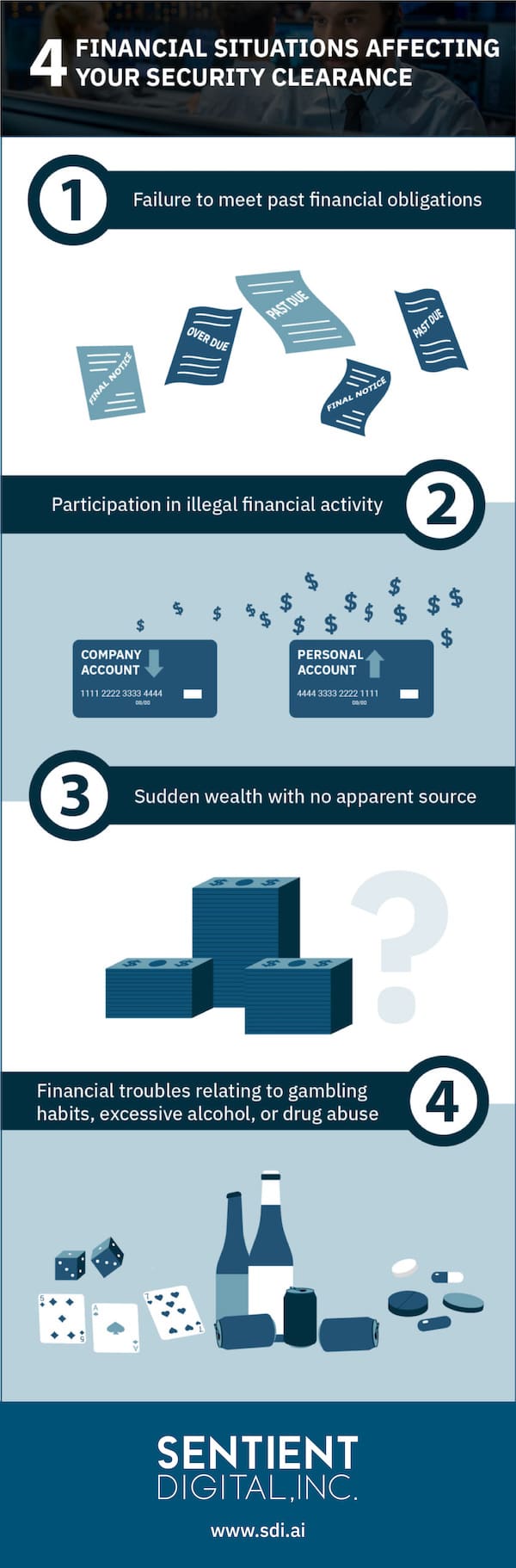

The specific financial situations that the Diplomatic Security Service will look for, according to the U.S. Code of Regulations, include:

- Failure to meet past financial obligations. Your record will be examined for past instances when you have been late to meet, or have failed entirely to meet, financial deadlines.

- Participation in illegal financial activity. The DSS will look into any illicit activity related to finances, such as income tax evasion, embezzlement, and employee theft.

- Sudden wealth with no apparent source. Even if you do not have any financial criminal acts on your record, a sudden and unexplained windfall of money will look suspicious to the DSS. This is because sudden influxes of money can indicate participation in illegal monetary activity that has yet to be discovered.

- Financial troubles connected to gambling habits, excessive alcohol, or drug abuse. Evidence that you have regularly spent beyond your means because of a gambling, alcohol, or drug problem could spell trouble for your security clearance eligibility. Note that any history of use of alcohol or drugs, among other activities, will be considered apart from any financial impact as well.

WHY DO FINANCES AFFECT SECURITY CLEARANCE?

Why are personal finances related to concerns about national security in the first place? From a national security perspective, people with high amounts of debt or other financial stressors are considered to be more likely to be tempted by criminals offering financial rewards in exchange for privileged information. The government must do everything possible to ensure the people it trusts with such information do not post a risk of engaging in such a transaction.

Keep in mind that the goal of the security clearance review process is not to call you out on every late credit card payment you’ve ever made or every time you’ve had a drink at a casino. Bearing in mind the justifications for this examination, as well as your reasons for seeking clearance, can help you tolerate the discomfort that may occur during the process. The DSS is ultimately trying to evaluate your entire character in relation to whether or not you can be trusted with sensitive information pertaining to our country, so maintaining an open and honest approach is critical.

WILL BAD CREDIT AFFECT SECURITY CLEARANCE?

As we’ve seen, many aspects of your personal finances, from defaulting on debts to losing money to gambling, are considered when you apply for security clearance. But what about your credit score? Will bad credit affect security clearance approval? Is there a specific minimum credit score for security clearance?

Credit scores are not specifically mentioned in the Code of Regulations as being examined by the Diplomatic Security Service. So when it comes to obtaining your security clearance, there isn’t a clear “cut off” point or range for acceptable credit scores. However, the underlying reasons for your bad credit may or may not affect your security clearance eligibility, depending on what they are. As we discuss below, a low credit score may be seen as evidence of a lack of financial responsibility, but if a different reason underlies your score, DSS will consider that.

WHEN BAD CREDIT AFFECTS SECURITY CLEARANCE

Numerous factors that can affect your credit score are mentioned or implied by the Code of Regulations as well. A credit report showing that you have defaulted on credit cards or loans, for instance, would impact your credit score as well as cause the Diplomatic Security Service to investigate further.

The debt you currently owe—which is another factor in determining your credit score—will also be reviewed during your security clearance application process. Less important than the dollar amount of debt is the percentage of your monthly debt compared to your monthly income, or the percentage of debt that is delinquent.

But what percentage of debt are we talking about? Although the DSS does not issue official numbers on this subject, the Consumer Protection Financial Bureau (CPFB) offers some insights about debt-to-income ratio.

The CFPB argues that, in general, a debt-to-income ratio under 37% is not cause for concern. If your monthly debt is more than 43% of your monthly income, however, that usually puts financial experts on the alert.

WHEN BAD CREDIT DOESN’T AFFECT SECURITY CLEARANCE, or at least not as significantly as you might think

If you want to obtain a security clearance for your IT career but you’re worried about your financial situation, don’t let that count you out from submitting your application. Ultimately, no matter if you’re worried about your credit score, debt-to-income-ratio, or defaulted loans, the reasons behind those incidents matter far more than the numerical amounts.

It matters, for instance, if your financial problems were caused by circumstances beyond your control. Financial hardships because of jobs lost without fault or health crises resulting in high medical bills may be looked upon with more leniency than financial woes caused by excessive gambling or regularly spending beyond your means.

It bears repeating that your credit will be considered in context, with the reasons for anything negative and how DSS feels that reflects on you carrying a lot of importance. In other words, being irresponsible with your finances is considered worse in the eyes of the Diplomatic Security Service than simply bad financial numbers.

OUR ADVICE FOR IMPERFECT FINANCIAL RECORDS

It’s important to underscore the fact that a rocky financial history does not immediately disqualify you from receiving security clearance. The federal employees of the DSS are more interested in determining if you know, or have learned, how to handle your finances responsibly, rather than making sure you have a perfect record.

If your financial path has included some bumps in the road, there may be actions you can take to try to improve your situation in the eyes of DSS. Just as the reasons behind your financial issues matter, so do the steps you’ve taken to address your financial challenges. If you have taken recent action to mitigate your debt, your defaulted payments, or other financial concerns, that shows the DSS that you take personal financial responsibility seriously. Even filing for bankruptcy, if this was a measure taken due to circumstances beyond your control, can be seen as a proactive step to correct your finances. Everyone’s application is different, but by being forthcoming with information, including explanations such as these, you will avoid damaging your chances by being cagey or dishonest.

TIPS FOR OBTAINING SECURITY CLEARANCE WITH FINANCIAL ISSUES

Here are our best tips for getting your security clearance application approved, even if you have experienced financial issues:

- Make at least the minimum payments on all outstanding debts or loans every month. Even if you have struggled to stay on top of your finances in the past, the DSS wants to see that you are making an effort to stay up to date with your payments now.

- Get credit counseling. Seek out a nonprofit organization with credit counselors who can help educate you on debt management and plan a realistic budget. Some credit counselors can even assist you in getting out of debt faster with lowered interest rates and consistent monthly payments. Make sure to choose only reputable nonprofits with proven track records; otherwise, you might unwittingly get scammed.

- Gather documentation for all financial hardships and mitigation attempts. At your security clearance interview, the DSS employees will likely want to see all documentation related to your past financial problems. Additionally, if you have taken steps to alleviate your financial hardships, make sure that you document those details. This includes relevant dates, names of individuals or organizations involved, and any other pertinent information.

- Review your current credit report. It’s important to obtain a recent copy of your credit report and make sure all of the information is accurate and up to date. Mistakes on your credit report could result in unnecessary investigations that potentially delay your security clearance or get your clearance denied altogether. You may have heard that requesting your credit report can lower your credit score. However, this type of “soft inquiry” (when individuals request their own credit score) does not bring down your credit score. Instead, “hard inquiries” such as those made by lenders are the inquiries that may lower your score.

Determining to what degree will bad credit affect security clearance isn’t easy to do. When reviewing security clearance applications, context ultimately is most important to the DSS than some particular credit score for security clearance. If you can demonstrate that the financial blemishes on your record were beyond your control, or that you’ve taken steps to correct them, the DSS will be less likely to count you out of the running for a security clearance.

WHAT TO DO IF YOUR SECURITY CLEARANCE IS DENIED

When an individual’s security clearance is denied, DSS provides the reasons and an opportunity to appeal. During your appeal you can give an explanation of the negative factors that DSS found, but of course this does not guarantee that you will ultimately receive security clearance.

While this information may seem intimidating, you need to try to make a realistic assessment of your chances and determine whether to proceed with applying for a security clearance. If you choose to apply, answer questions honestly and completely, and have patience with the process. Your employer may also provide assistance throughout the process.

Even If You Obtain Your Security Clearance, You Still Need To Be Careful with Your Finances

People who hold security clearances have always needed to be careful about their behavior. This is true because they hold the trust of the public and have a role to play in preserving national security. However, this is also because of ongoing self-reporting requirements, which include financial issues, as well as the reinvestigation process. However, recently there has been an emphasis on “continuous evaluation” as part of an initiative called Trusted Workforce 2.0. With your finances as well as other aspects of your life potentially subject to scrutiny at all times, in addition to the ongoing self-reporting requirements, it only makes sense to manage your money with care if your security clearance is granted.

Learn About Working for The Government and Military with Sentient Digital, An Experienced Contractor

Sentient Digital, and its subsidiary, RDA, have extensive experience in government and military contracting (as well as performing work for private sector clients). We appreciate the opportunity to share the insights we have gained over the years and continue to gain as we take on new projects.

If you are interested in learning more about topics related to security clearance specifically in the IT field, consider this article that may help you weigh the considerations to decide whether you should seek a security clearance to further your IT career. Similarly, if you are a career-minded IT professional already working for an organization supporting the U.S. military, a great next step for you might be seeking FSO certification.

Beyond individual career success, success for a small-to-medium sized business interested in contracting can become possible thanks to programs such as SBIR that allow them to compete more effectively for R&D projects. SDi and RDA’s experience over the years has only further strengthened their commitment to the quality culture that supports taking on the challenge of projects like these. We believe that sharing what we have learned with like-minded people and organizations fosters the potential for future collaboration and facilitates the development of our ever-evolving field. Visit our blog to learn more about military, government, and private sector work, as well as the technology, the processes, and the people who make it all possible.